Financial services plan to benefit all

FORUM: Shadow City minister Tulip Siddiq outlines the Labour Party’s vision for the financial sector

Thursday, 15th February

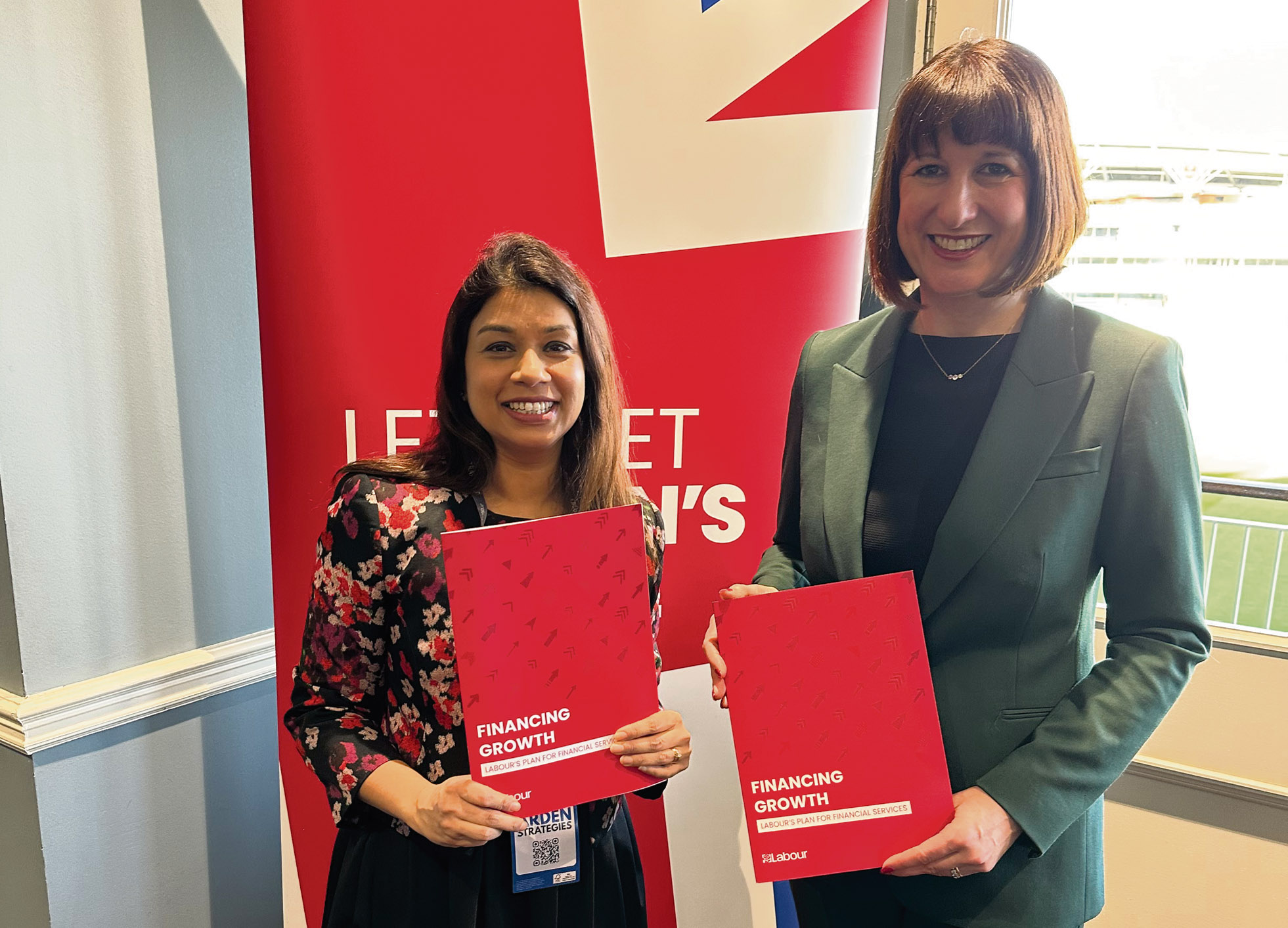

Tulip Siddiq and Rachel Reeves with Financing Growth: Labour’s Plan for Financial Services

LABOUR’S plan for financial services will ensure we all benefit from its success.

It is now over two years since Sir Keir Starmer asked me to take on the role of shadow City minister and I am extremely proud of the work we have done in that time to develop Labour’s plans for the financial services sector, which is responsible for more than 12 per cent of UK GDP and crucial to our growth prospects.

With the next election fast approaching, I was very pleased to launch Labour’s financial services review with shadow chancellor Rachel Reeves at our recent business conference, setting out our vision for the sector under a Labour government.

Our financial services industry remains one of Britain’s greatest economic success stories and employs more than 400,000 people across London.

Labour has set out an ambitious plan to unlock billions of pounds of growth and secure those jobs well into the future.

Unsurprisingly, strengthening consumer protections and boosting financial resilience is at the core of Labour’s approach to financial services.

That is why our report sets out a series of announcements designed to support financially vulnerable individuals and small businesses in areas like Camden.

For example, Labour will work with the banks to encourage increased offering of longer-term fixed rate mortgages, which will help people get on the housing ladder and allow people more choice over the type of mortgage which suits their needs.

We will also take urgent action to regulate Buy-Now-Pay-Later products; the government has kicked reform into the long grass, leaving millions of consumers unprotected.

Labour will address this unacceptable delay and swiftly deliver a new regulatory regime.

We know that London is the fraud capital of the UK, with Londoners disproportionately likely to report themselves a fraud victim compared to the rest of the country.

Labour will take a new approach to stopping scams, requiring government, financial services firms, and social media platforms to collaborate and share data and intelligence to address this growing issue.

The disappearance of bank branches across the country has hit close to home in my own constituency of Hampstead and Kilburn where 60 per cent of all branches have closed since 2015.

This is deeply worrying, and not just for older people who we know are more likely to opt for branch services over online banking.

Through Labour’s “banking hub guarantee” we will address this, ensuring that communities left without access to a bank branch will receive a new shared hub, protecting the essential face-to-face services our communities rely upon.

To meet the challenges of the future we have to make sure government is embracing new technologies and creating the right conditions for innovation.

The UK has historically led the world in fintech. However, we are now in danger of slipping behind. Paris, for example, is emerging as a competing fintech capital in Europe to London.

A Labour government would be serious about revitalising our status as a global fintech centre, by building a regulatory regime that delivers our ambition to make Britain the home-grown start-up hub of the world.

• Tulip Siddiq is MP for Hampstead & Kilburn.